Also available - EMOTIONAL MANAGEMENT FOR ORDINARY FOLK

WISDOM, HUMOUR, AND LOTS OF OTHER INTERESTING STUFF CAN BE FOUND ON MY PINTEREST PAGE and FACEBOOK PAGE

TO FIND OUT WHAT I DO, CHECK OUT MY WEBSITE

1. ON THIS DAY IN HISTORY

9th January 1799

The Birth of Income Tax

The first ever income tax was introduced into Great Britain by Prime Minister William Pitt the Younger in his budget of December 1798, to pay for weapons and equipment for the French Revolutionary War. Pitt's new graduated (progressive) income tax began at a levy of 2 old pence in the pound (1/120) on incomes over £60 (£5,641 as of 2016), and increased up to a maximum of 2 shillings in the pound (10%) on incomes of over £200. Pitt hoped that the new income tax would raise £10 million a year, but actual receipts for 1799 totalled only a little over £6 million.

Pitt's income tax was levied from 1799 to 1802, when it was abolished by Henry Addington during the Peace of Amiens. Addington had taken over as prime minister in 1801, after Pitt's resignation over Catholic Emancipation. The income tax was reintroduced by Addington in 1803 when hostilities with France recommenced, but it was again abolished in 1816, one year after the Battle of Waterloo. Opponents of the tax, who thought it should only be used to finance wars, wanted all records of the tax destroyed along with its repeal. Records were publicly burned by the Chancellor of the Exchequer, but copies were retained in the basement of the tax court.

In the United Kingdom of Great Britain and Ireland, income tax was reintroduced by Sir Robert Peel by the Income Tax Act 1842. Peel, as a Conservative, had opposed income tax in the 1841 general election, but a growing budget deficit required a new source of funds. The new income tax, based on Addington's model, was imposed on incomes above £150 (£12,611 as of 2016),. Although this measure was initially intended to be temporary, it soon became a fixture of the British taxation system.

A committee was formed in 1851 under Joseph Hume to investigate the matter, but failed to reach a clear recommendation. Despite the vociferous objection, William Gladstone, Chancellor of the Exchequer from 1852, kept the progressive income tax, and extended it to cover the costs of the Crimean War. By the 1860s, the progressive tax had become a grudgingly accepted element of the English fiscal system.

The US federal government imposed the first personal income tax, on August 5, 1861, to help pay for its war effort in the American Civil War - (3% of all incomes over US $800) ($21,070 in 2016 dollars). This tax was repealed and replaced by another income tax in 1862. It was only in 1894 that the first peacetime income tax was passed through the Wilson-Gorman tariff. The rate was 2% on income over $4000 ($109,400 in 2016 dollars), which meant fewer than 10% of households would pay any. The purpose of the income tax was to make up for revenue that would be lost by tariff reductions.

In 1913, the Sixteenth Amendment to the United States Constitution made the income tax a permanent fixture in the U.S. tax system. In fiscal year 1918, annual internal revenue collections for the first time passed the billion-dollar mark, rising to $5.4 billion by 1920.

2. TODAY IN MY LIFE

Blogging

The paper run

Online promotional work

Me Time

Sleep Catch-up

Missus Time

Twitter Followers = 2,065 (down 4)

Non-followed eliminated = 4

untraced

Unfollowers eliminated = 1

@WHC_Director

New Followers followed back = 1

@JoeyKleinCT

Spammers not followed back =0

-

3. TODAY'S SELF-OBSERVATION

Though not 100% beer-and-skittles, it is nevertheless going to be pleasant to avoid the Weekend Job today and enjoy a feast of TV footie. Though I have the house to myself for a morning it will soon fly after blogging and a soak in the tub. Son has also kindly left me his bedding to launder! None of this adds up to a complaint. In fact, I have no complaints whatsoever. I am fully aware that I am living in Shangri-La for which I am profoundly grateful.

I am particularly pondering today on the Discipline of Acceptance. I tend to invoke it by the mantra "stop struggling and relax". I cannot fight my mistakes, losses, frustrations and disappointments - I simply have to let them be there and focus on the difference I can make now. I liken it to accepting a general anaesthetic - you're fearful of losing control but ultimately you decide you don't want to suffer, so you just relax and lie back as you feel it being injected and rising up your arm...

4. TODAY'S QUESTION FOR YOU

Have you come to the point of acceptance over what you have lost?

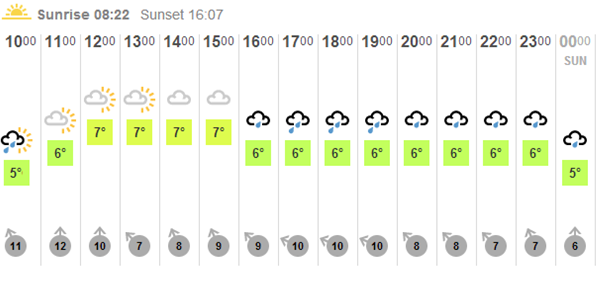

5. TODAY'S WEATHER IN BRADFORD

Moon

Weathertrack

7. NOW THAT'S FUNNY!

Esther Povitsky on Married People

8. TRIVIA

Chronic stress increases cytokines, which produce inflammation. Exposure to constant inflammation can damage arteries and other organs

9. ZEN WISDOM

When we care for others our own strength to live increases. When we help people expand their state of life, our lives also expand. Actions to benefit others are not separate from actions to benefit oneself. Our lives and the lives of others are ultimately inseparable.

No comments:

Post a Comment